The online gambling industry is an internet-dependent sphere that changes upon the emergence and disappearance of technologies and trends. The popularity of casino content is directly reflected by the current situation in the world and particularly the digital environment. Wise operators monitor the global market, trying to apply vital amendments to the entertainment industry.

Casino Market is a long-standing participant of the sphere that has successfully implemented all kinds of innovations in the designed projects. Our experts continuously follow the market for any ideas that might improve the performance of online casinos and involve more traffic. As a result, the summary of the first half of 2021 was recapped. We are ready to present to you trends and opinions of the iGaming industry.

Online Gambling in 2021: What Is in Trend?

This year has brought different ups (cryptocurrency rise) and downs (Coronavirus influence) in the sphere. Thanks to a detailed analysis of all influencing factors, it is possible to distinguish top web gambling trends for the middle of 2021.

Online Gambling Industry Climate

To understand the situation currently happening in the iGaming sphere, an expert survey was conducted among the industry members. 170 area specialists, executive officers, and operators have been questioned to evaluate the state of industry preparedness.

The results of the poll divided as follows:

- 51% of respondents claimed that the iGaming sphere is in good condition;

- 42% of experts called the current situation as satisfactory;

- 7% of surveyed mentioned that the business segment is in a poor state.

Another question of the poll asked to predict the situation for the next year (until the middle of 2022):

- 62% expressed good development for the following 12 months;

- 31% mentioned the satisfactory state of affairs;

- 7% still considered a poor condition of the industry in a year.

The survey was a long-term experiment, started at the beginning of 2018. Since then, experts have worsened their grading of the industry. The peak of negative reviews occurred in March 2020 (during the beginning of the Coronavirus pandemic). After that, the respondents of the survey improved their estimation of the iGaming condition.

Growth of Product Trends

The overall increase of the industry popularity and its business climate did not save the product-related growth estimates from decreasing. The reason for this lies in lowered expectation from some trends in particular and the boost of the sphere as a whole.

Here is the rating by places with the indicated growth for the last 12 months:

- Mobile sports wagering: -7%.

- Live sports wagering: -5%.

- Mobile gambling: -11%.

- Live gambling: +3%.

- Cybersports: -1%.

- Mobile sweepstakes: +2%.

- AI-driven gambling: -1%.

- Crypto casino: +14%.

- Mobile bingo: +10%.

- Mobile poker: -8%.

As we can see, the general trend dictates the following reasoning:

- the mobile iGaming industry holds 5 out of the top 10 positions over the last year;

- the boom for mobile gambling and wagering is dropping but is still high;

- casinos that utilise cryptocurrency are gaining increased popularity;

- online bingo entertainment has returned its position in the top 10 gambling trends.

Let us analyse these trends with some additional details:

Mobile Gambling

This sector has become crucial for operators in terms of revenue. On average, 75% of all profit that online casino owners receive comes from mobile gambling. Due to increased market competition, a lot of firms do not publicly declare their profits. But from the available data, 79% of the revenue is the maximum part that operators receive from the mobile segment.

Betting applications perform incredibly well in this direction of the sphere. Some mobile programs are ranked extremely high (2nd and 3rd positions) in some local markets (i.e. Germany, Sweden, the UK) of Google Play and App Store.

Most recognised betting applications:

- Tipico;

- Bet365;

- Svenska Spel;

- ATG;

- Bwin;

- Sky Bet;

- Betfair;

- William Hill.

Mobile casino applications also impress with their popularity. Usually, they are ranked lower than betting programs. But such entertainment still holds firm positions (2nd, 4th, etc.) in some top suppliers’ markets (Spain, the UK, the US, Sweden).

Most recognised casino apps:

- 888 Casino;

- Sky Vegas;

- 777 Casino;

- Leo Vegas;

- Casumo;

- PokerStars;

- FanDuel;

- DraftKings.

Players’ Recommendations and Further Development

According to the number of visitors up until the middle of 2021, the most suggested online gambling company turned out to be 888 Casino. The online casino venue has also shown the best development progression since the beginning of the year.

In general, the online gambling industry has shown all signs of outperformance since the beginning of 2020, after the Coronavirus outbreak. In comparison to the retail sphere, the turning point happened right after the lockdown was initiated.

The Coronavirus pandemic has influenced a lot of spheres negatively, but it seems to touch the iGaming industry without much pain. The majority of sports events have been cancelled or postponed, meaning sportsbook sites had to accustom. But the wise and quick understanding of the situation allowed operators to switch to fantasy sports, virtual bets, wagering on casino content, and other enjoyable activities.

As the result of the company’s adaptation after the pandemic crisis, the market can also be analysed from the point of view of a stock exchange. The keys points here are:

- The shares of major iGaming companies played on the market better in comparison to FTSE 100.

- The industry is estimated to continue positive growth in the nearest months.

- The most gainful gambling organisation in the online industry was GIG, making progress of 93% in the last quarter.

- The average tendency of iGaming market representatives equals +36% over the recent 3 months.

- The leader of multi-channel online gambling organisations is Entain with a rise of +34% up until the middle of 2021.

- The increase of online/retail venues in comparison to web gambling firms was +16% to +36%.

Revenue Progress and Estimation

Over the last year, the profits of the majority of online casino companies have increased. Depending on how well the adaptation after the Coronavirus went, different projects have distinct progress. The average revenue growth for the end of 2020 was +48%.

Top five most gainful web casino representatives:

- DraftKings: +122%;

- Enlabs: +90%;

- Better Collective: +87%;

- 888 Casino: +80%;

- Kambi: +76%.

The main reasons for the top two companies managing to show such significant growth in revenue up until the middle of 2021:

| DraftKings | The total income of the company is reported to have equalled $291 million. Increased client acquisition was possible thanks to a powerful marketing campaign and appealing conditions of the revived sports schedule. |

| Enlabs | Favourable business conditions in Baltics allowed gaining exceptional revenue growth for the company. After the acquisition of Optibet, Global Gaming, and further consolidation with Entain, the brand is among the largest market representatives. |

The betting segment of the sphere has also experienced a major revenue increase over the last 12 months. On average, these figures equal +44% of the growth rate. Such analysis considered net gaming revenue, meaning venues’ profits after the bonuses.

Top five most gainful online sportsbook representatives:

- 888: +100%;

- France total (ARJEL): +63%;

- Kindred: +60%;

- Entertain Online: +59%;

- Betsson: +47%.

The EBIT figures (earnings before interest and taxes) are also an interesting field for analysis. Though not all companies display these numbers, some companies impress with their growth here. The average increase over the last quarter of 2020 is +163%, but it was possible thanks to a single huge gain.

Top three iGaming representatives by earnings before interest and taxes:

- Kindred: +650%;

- Angler Gaming: +97%;

- Betsson: +59%.

Investigation of iGaming Marketing Growth

The average increase of advertising positions over the period to the middle of 2021 was +19%. The biggest inflow of popularity was reported by Betsson: +44%.

Let us analyse the marketing growth by popular social media:

| Platform | Facebook / Twitter / Instagram | ||

| Average | 961,687 likes (+0.5%) / 165,924 followers (+0.8%) / 103,017 followers (+2.8%) | ||

| Top representative | PokerStars / Paddy Power / PokerStars | ||

| Top numbers | 2,176,423 likes / 656,043 followers / 714, 361 followers | ||

| Second place | Bet365 / Bet365 / Paddy Power | ||

| Third place | Paddy Power / Unibet / Party Poker | ||

| Biggest gain | +2.1% (Netbet) / +12.9% (Netbet) / +4.9% (PartyPoker) | ||

Over the second half of 2020, a lot of operators increased their marketing costs to ensure better acquisition. The average raise for advertising expenses was reported to be +34%.

Top five iGaming representatives with biggest marketing expenses:

- 888: +92%;

- Churchill Downs: +51%;

- PPB Online (Paddy/Betfair): +41%;

- Betsson: +35%;

- Zeal/Tipp24: +25%.

The global trend of increased marketing expenses goes along similarly advancing profits of iGaming companies. It allows predicting further growth of the industry's popularity in the international arena.

The global social network serves as an amazing promotional platform for operators of online casinos and sportsbook sites. The analysis of Facebook likes and their change over the first quarter of 2021 allowed us to single out the biggest leaders in this area. The average number for this period was 961,687.

Top popular representatives of gambling venues on Facebook:

- PokerStars: 2,176,423 (+1.5%);

- Bet365: 1,901,325 (+0.2%);

- Paddy Power: 1,590,076 (-0.01%);

- Unibet: 924,604 (+0.8%);

- William Hill: 847,293 (+0.2%).

The average growth trend over the first quarter of 2021 is reported to be +0.5%. The leader of maximum gain for this period is Netbet with a +2.1% increase.

An image-based social platform is also considered a large promotional environment. The official representative of the iGaming sphere established a returning audience with the number of followers constantly increasing. The average number of subscribers in the first quarter of 2021 was 103,017.

Top Instagram accounts of web casino and betting spheres:

- PokerStars: 714,361 (+3.7%);

- Paddy Power: 176,509 (+0.4%);

- PartyPoker: 66,039 (+4.9%);

- Betsafe: 45,008 (-2.1%);

- Bwin: 27,331 (+0.4%).

The average growth trend over the first quarter of 2021 is reported to be +2.8%. The biggest gain of followers for this period is PartyPoker with +4.8% respectively.

YouTube

The platform of video content also has a gainful advantage for online casino operators. Official representatives of gaming companies regularly post informative material on their channels to attract users to their products. The average number of subscribers in the first quarter of 2021 is 112,019.

Top YouTube channels with the most populous audience:

- PokerStars: 1,020,000 (+7.8%);

- Bwin: 83,700 (-0.1%);

- Betsafe: 63,819 (+2.7%);

- Betfair: 34,300 (+3.3%);

- William Hill: 20,500 (+1.0%).

The average growth trend over the first quarter of 2021 is reported to be +6.6%. The maximum gain of subscribers for this period is PokerStars with +7.8%.

Analysis of Affiliate Propositions

Among all types of casino advertising, partner marketing has earned the leading first place in terms of efficiency. Most successful affiliate sites cooperate with top representatives of the iGaming sphere.

The analysis embraced the following verticals:

- top 50 Google partner portals with most used gambling-related keyphrases;

- different online casino companies that appeared on those affiliate sites;

- the distinction of same iGaming firms on casino- or betting-related portals;

- most demanded European destination with the highest demand of gambling services.

According to the received data, a few leading gaming organisations turned to appear in the majority of analysed affiliate sites:

| Brand | Percentage of casino sites / Percentage of betting sites | |

| LeoVegas | 73% / 45% | |

| Unibet | 46% / 69% | |

| Betway | 51% / 61% | |

| Betfair | 45% / 60% | |

Betting Specific Affiliates

Sportsbook-oriented resources outnumber online casinos due to the prohibition of gambling-content promotion in some destinations. The investigation of operators’ spreading in the European market considered top 50 Google search results with 20-30 key phrases each.

The analysis of the company’s appearance by separate countries have shown the following results (by the first quarter of 2021).

The United Kingdom (133 affiliate portals):

- Bet365 — 88%;

- Betfair — 83%;

- Ladbrokes — 77%.

Germany (112 affiliate portals):

- Betway — 85%;

- Bwin — 85%;

- Bet365 — 85%.

France (156 affiliate portals):

- Unibet — 98%;

- Betclic — 89%;

- Bwin — 83%.

Spain (77 affiliate portals):

- Bet365 — 88%;

- Betfair — 87%;

- Codere — 83%.

As it is seen from the report, even though some local-based sportsbook companies appear on affiliate portals of separate countries, the majority of the market is occupied by globally renowned brands.

Casino Specific Affiliates

Regardless of less advertising capacity with the help of partner marketing, casino-based sites still occupy a huge promotional environment in Europe. The investigation of operators’ spreading in the local area considered top 50 Google search results with 20-30 key phrases each.

The analysis of the company’s appearance by separate countries have shown the following results (by the first quarter of 2021).

The United Kingdom (60 affiliate portals):

- LeoVegas — 60%;

- Videoslots — 57%;

- Casumo — 48%.

Germany (112 affiliate portals):

- LeoVegas — 77%;

- Wunderino — 66%;

- Betsson — 65%.

Sweden (176 affiliate portals):

- LeoVegas — 81%;

- Casumo — 76%;

- Betsson — 63%.

Spain (78 affiliate portals):

- Betsson — 76%;

- Betway — 72%;

- Betfair — 68%.

Most Effective SEO Application

Search engine optimization is a vital advertising aspect in many spheres. The ability to utilise it productively distinguishes good operators from inexperienced ones. With the consideration of country-based distinction, the investigation of popular European brands is as follows.

The analysis embraced the following verticals:

- top 50 Google organic queries within most demanded markets in the region;

- the usage of particular versions of the search engine to each country with 20–30 key phrases in different languages;

- all results were ranked with points according to the respective position of the brand in each European state.

Betting Specific SEO

The received points indicate the popularity of a particular brand and the frequency of its appearance in the results of Google search.

The United Kingdom (24 key phrases involved):

- William Hill — 100;

- Paddy Power — 97;

- Betfred — 96;

- Betway — 92.

Germany (20 key phrases involved):

- Tipico — 100;

- Betway — 98;

- Bwin — 87;

- 888 Sport — 71.

Spain (16 key phrases involved):

- Betway — 100;

- Bwin — 71;

- Luckia — 59;

- Sportium — 56.

Casino Specific SEO

The received points indicate the popularity of a particular brand and the frequency of its appearance in the results of Google search.

The United Kingdom (23 key phrases involved):

- Paddy Power — 100;

- 32red — 100;

- NetBet — 92;

- 888 Casino — 92.

Germany (25 key phrases involved):

- NetBet — 100;

- Hyperino — 82;

- Online Casino Dtld. — 73;

- Stargames — 70.

Spain (30 key phrases involved):

- 888 Casino — 100;

- Casino 777 — 70;

- Casino Gran Madrid — 66;

- Betway — 61.

iGaming Affiliate Influence in European SEO

The same grading point was applied upon the investigation of popular partner portals in the region. Considering the narrow direction of most sites, the majority of them are country-specific. Only a few were able to expand beyond the borders of their locality and managed to target different states (i.e. Oddschecker).

Analysis of affiliate sites with the point system:

The UK

Betting-based:

- Oddschecker — 100;

- Olbg — 58.

Casino-based:

- Casino — 100;

- Gambling — 82.

Spain

Betting-based:

- Sportytrader — 100;

- Miscasasdeapuestas — 87.

Casino-based:

- Slotjava — 100;

- Casasdeapuestas —71.

Germany

Betting-based:

- Wettbasis — 100;

- Wettfreunde — 93.

Casino-based:

- Onlinecasinosdeutschland — 100;

- Gambling — 82.

Analytical Investigation of Betting Products

The popularity of certain gambling services decided the acceptance of the brand by players. This analysis studied the most frequent bets to understand what offerings are the most popular in the iGaming market.

Football in Europe

It is among the top demanded activities in this area. The majority of wagering offers are made in this type of sport.

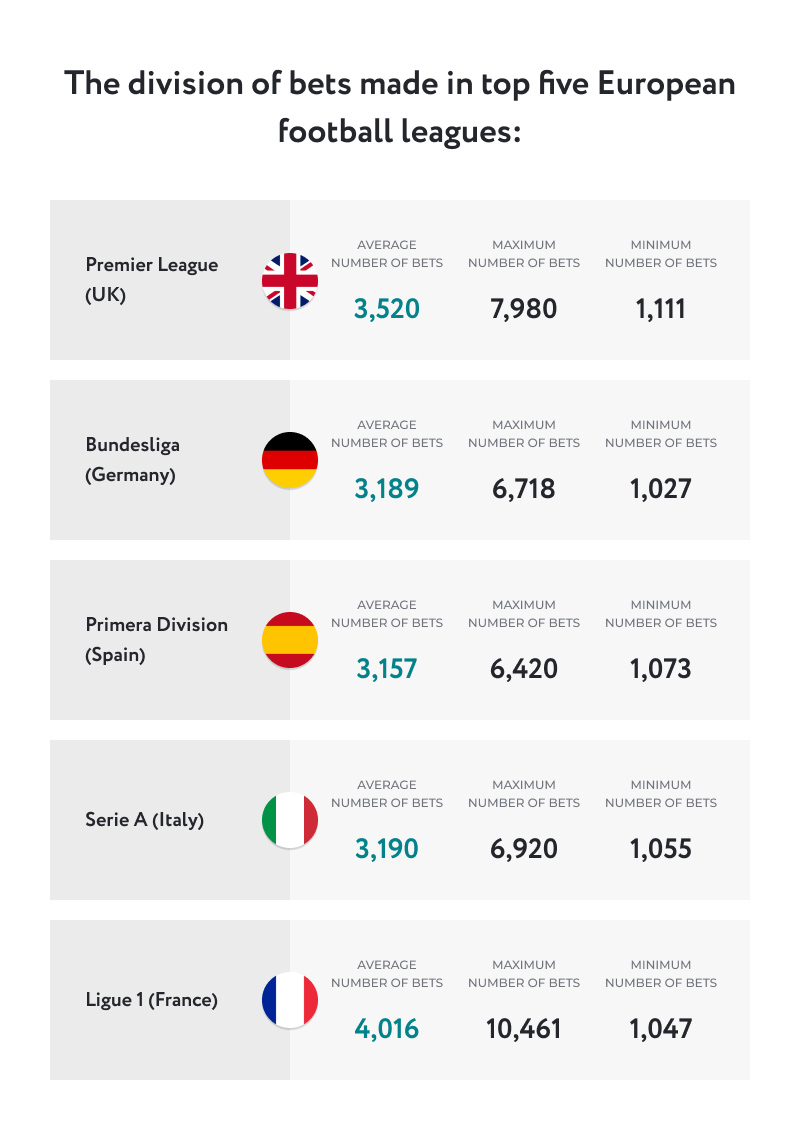

The division of bets made in top five European football leagues:

| League | Average number of bets / Maximum number of bets / Minimum number of bets | ||

| Premier League (UK) | 3,520 / 7,980 / 1,111 | ||

| 1.Bundesliga (Germany) | 3,189 / 6,718 / 1,027 | ||

| Primera Division (Spain) | 3,157 / 6,420 / 1,073 | ||

| Serie A (Italy) | 3,190 / 6,920 / 1,055 | ||

| Ligue 1 (France) | 4,016 / 10,461 / 1,047 | ||

While some gambling brands focus on particular tournaments and offer a small variety of activities, others focus on much broader numbers. Football is the most popular sport in Europe, so top-tier sportsbook brands orient on this activity above others.

The average number of bets offered is 17,071 among the five most demanded leagues. The leader of the mass proposition in Europe is William Hill. The sportsbook brand provides two times more wagering possibilities than its closest competitor Unibet.

NFL in the US

While regular football (aka soccer in the US) prevails in the European market, America’s favoured betting discipline is a different type of football. The major NFL league is the most frequent target for wagering. The Covid-19 has hardly influenced the sport in any approach.

The most important analysis results of NFL up until the middle of 2021:

- After the 2019/2020 Super Bowl tournament, 60% of punters visited their sportsbook sites again for more bets.

- Almost all (9/10) entertainment for handle in the recent season turned out to be standalone and made almost four times more revenue than non-standalone activities.

- The income from bets on Kansas City and Tampa Bay Buccaneers increased several times in comparison with 2020.

- The number of live punters grew by almost 400%.

- Instant wagering occupied 40% of all live betting on NFL games with more than a third of all players tried this type of betting.

- Mobile-based stakes that were made during matches were placed two times more than before games.

The Popularity of Casino Products

The main reason why different gambling sites have a distinct assortment of content is regulation. Some do not have appropriate licences while others have no right to provide corresponding services due to local legislation. The two most common regions in the selection of casino entertainment are Sweden and Spain.

Spanish Gambling Offerings

Slot, jackpot, and tabletop games are the most demanded types of amusement in the country. The analysis features the top five providers of this entertainment on the territory of the country. The average number of slots games is 375.

Top four Spanish representatives of this content:

- Bwin — 954;

- Casino777 — 678;

- Luckia — 642;

- 888Casino — 529.

The average number of offered jackpot games is 33. Top four Spanish representatives of this content:

- Sportium — 73;

- Betfair — 68;

- 888Casino — 58;

- Bwin — 54.

Swedish Gambling Offerings

Similarly to the Spanish market, the analysis of slots and jackpot games was conducted in this country. The average number of slots per site in Sweden is 1,190.

Top four Swedish representatives of this content:

- Videoslots — 2,608;

- Speedy Casino — 2,393;

- LeoVegas — 1,757;

- Guts — 1,638.

The average number of offered jackpot games is 74. Top four Swedish representatives of this content:

- Videoslots — 198;

- Unibet — 158;

- Mr Green — 102;

- Vera&John — 101.

The Main Things about Trends and Analysis of the Gambling Industry in 2021

The first year after the peak of the Coronavirus outbreak can be summed up positively from the point of iGaming view. Online casinos and betting stores were able to adapt and received significant support from players. Also, new gambling websites actively appear on the horizon and try to compete with the tycoons of the industry.

Key notions to keep in mind about iGaming trends in 2021:

- the results of the experts’ poll claimed that the sphere is in good (51%) and satisfactory (42%) conditions;

- mobile and live gambling continue to hold leading positions by popularity, regardless of losing some percentages in demand;

- top three European brands by revenue as for this period are DraftKings, Enlabs, and Better Collective;

- Instagram, Facebook, Twitter, and YouTube are the most widely used social networks for efficient SMM advertising;

- affiliate marketing stays on the top of the most demanded promotional methods of online casinos and sportsbook sites;

- effective search engine optimisation allows operators to attract major sources of traffic from Google and similar pages;

- the most wagered type of product in Europe is soccer, while the US’ most demanded sport to bet on is football (American);

- the difference in legislation in the European casino market does not allow us to understand the general trend, but slot entertainment is undoubtedly the leader here.

The experts from Casino Market keep monitoring the latest trends of the iGaming industry. Constant analysis of the situation in Europe and other regions allows our clients to come up as leaders of local operational zones.

If you are looking forward to starting an independent gambling brand, resort to a professional aggregator Casino Market. Order our finest services: a turnkey solution, business plan development, casino scripts, Blockchain platforms, and many others.

Reach us out via any convenient method:

- Skype: support.casinosupermarket

- e-mail:[email protected]

- the feedback form.

Have questions or want to order services?

Contact our consultants:

- e-mail: manager@casino-market.com

- feedback form.

Check the information used to contact us carefully. It is necessary for your safety.

Fraudsters can use contacts that look like ours to scam customers. Therefore, we ask you to enter only the addresses that are indicated on our official website.

Be careful! Our team is not responsible for the activities of persons using similar contact details.